How ibana uses technology to detect financial fraud

In today's landscape riddled with financial fraud, businesses are constantly seeking robust defenses to safeguard their transactions. ibana emerges as a leading platform, offering meticulous protection through the strategic application of technology. This article delves into how ibana employs advanced techniques to detect and prevent financial fraud.

ibana transaction analysis

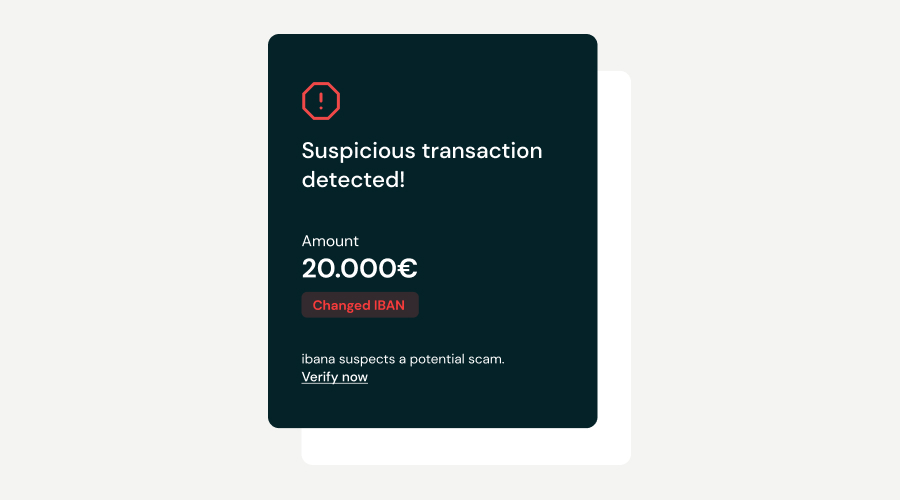

At the heart of ibana's fraud detection capabilities lies its transaction analysis. The system meticulously examines each business transaction, scrutinizing various aspects to identify potential red flags. These crucial factors include:

- Previous transactions: ibana checks for any prior transactions with the same partner. This helps establish a baseline of trust, as recurring interactions can signal a legitimate business relationship.

- IBAN - Name relation: ibana evaluates the combination of IBAN (International Bank Account Number) and the associated name. It determines whether this combination is recognized or if it's the first time ibana encounters this particular match.

- Transaction volume: The system assesses whether the transaction volume aligns with historical transactions. Significant deviations from established patterns can trigger suspicion.

These three criteria enable ibana to form an initial assessment of a transaction's legitimacy. However, ibana's capabilities extend beyond this initial analysis.

ibana database

ibana boasts an extensive network of transaction data, enabling it to cross-reference IBAN - Name combinations from numerous payers. For instance, if 100 different businesses are transferring funds to a specific IBAN under the name "Company X," ibana's system will flag any instances where a different name, such as "Company Y," is associated with the same IBAN. This cross-referencing enhances ibana's ability to detect irregularities and suspicious activities in real-time.

ibana AI

As part of its commitment to continuous improvement, ibana is developing a sophisticated AI algorithm set to revolutionize its fraud detection capabilities. Expected to launch in mid-2024, this AI system will further bolster ibana's defenses against financial fraud. By employing machine learning and data analytics, it will be capable of identifying anomalies and potential fraud patterns with unparalleled accuracy and speed.

Conclusion

In conclusion, ibana stands at the forefront of technology-driven financial fraud detection. Its multifaceted approach, which encompasses transaction analysis, extensive database cross-referencing, and forthcoming AI integration, equips businesses with the robust defenses necessary to protect their financial transactions in an era fraught with risks. As the threat of financial fraud continues to evolve, ibana remains committed to staying ahead of the curve, safeguarding businesses and their financial assets with cutting-edge technology.