Verify transactions with ibana

In our previous post, we explored how ibana effectively detects potential fraud attempts. However, merely identifying suspicious activity is only part of the equation. To ensure that payments are made to the right recipients, ibana goes the extra mile by offering a robust system for transaction verification. This article delves into the two powerful verification mechanisms employed by ibana, enhancing security and trust in financial transactions.

Account Owner Verification (AOV)

One fundamental aspect of ibana's transaction verification is the Account Owner Verification (AOV). AOV plays a crucial role in establishing the true owner of a given bank account, a vital defense against impersonation, counterfeit invoices, or fraudulent alterations to bank data.

The process is as follows:

- ibana initiates an email notification to the account owner.

- The account owner securely logs into their online banking account through the ibana platform.

- ibana, leveraging open banking technology, retrieves the most up-to-date account information and promptly shares the verified account name with the requesting company. By tapping into bank servers directly, AOV ensures that the information is not only accurate but also highly secure, bolstering confidence in the authenticity of the transaction.

2-Factor Verification

One of the most pervasive and damaging forms of fraud is CEO fraud, where malicious actors impersonate top executives to request illicit money transfers. To counter this threat, ibana offers a robust 2-factor verification system.

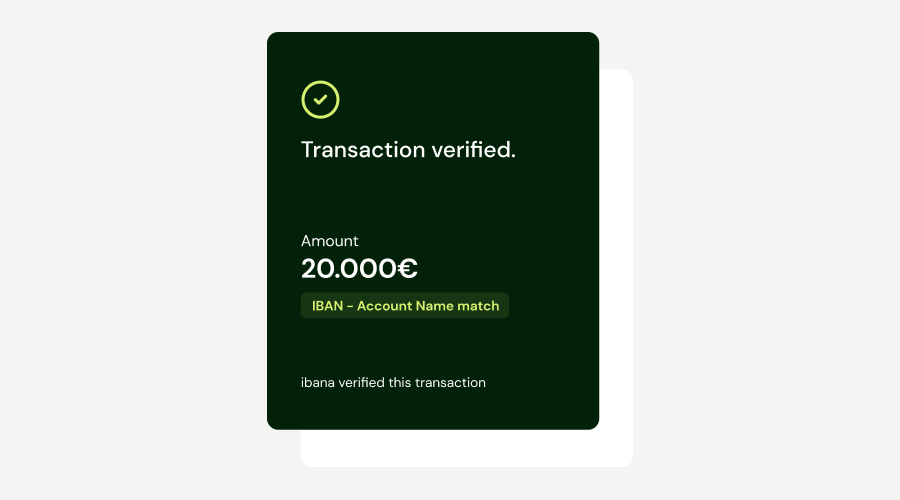

Suspicious transactions undergo a verification process where authorization from a senior employee is required. This verification takes place through the ibana verification mobile app. Here's how it works:

The senior executive receives a notification on their mobile device, prompting them to verify a specific transaction. If the transaction aligns with their approval, the funds are released. If the executive doesn't recognize the transaction as legitimate, it is promptly halted, preventing any unauthorized transfers. This two-factor verification system adds an extra layer of protection, significantly reducing the risk of fraudulent financial activities.

Conclusion

ibana's commitment to financial security extends beyond mere fraud detection. With its advanced transaction verification mechanisms, including Account Owner Verification and 2-Factor Verification, ibana ensures that not only are potential threats identified but also that payments are made to the rightful recipients. These measures reinforce trust and provide businesses with the peace of mind they need in an increasingly complex and hazardous financial landscape. ibana's dedication to enhancing security sets a new standard for safeguarding financial transactions in today's digital age.